Getting The Hsmb Advisory Llc To Work

The Basic Principles Of Hsmb Advisory Llc

Table of ContentsGetting The Hsmb Advisory Llc To WorkThe Greatest Guide To Hsmb Advisory LlcThe Definitive Guide to Hsmb Advisory LlcHsmb Advisory Llc Fundamentals ExplainedIndicators on Hsmb Advisory Llc You Should KnowHsmb Advisory Llc for BeginnersThe Buzz on Hsmb Advisory Llc

Be aware that some plans can be costly, and having particular wellness conditions when you apply can boost the premiums you're asked to pay. You will need to see to it that you can pay for the premiums as you will require to commit to making these repayments if you want your life cover to stay in positionIf you feel life insurance policy might be advantageous for you, our collaboration with LifeSearch enables you to obtain a quote from a variety of providers in double double-quick time. There are various sorts of life insurance policy that aim to fulfill various security requirements, consisting of level term, reducing term and joint life cover.

Some Ideas on Hsmb Advisory Llc You Should Know

Life insurance policy supplies 5 monetary benefits for you and your family members (Insurance Advise). The major advantage of including life insurance policy to your economic plan is that if you pass away, your beneficiaries receive a round figure, tax-free payout from the plan. They can use this money to pay your final expenses and to replace your earnings

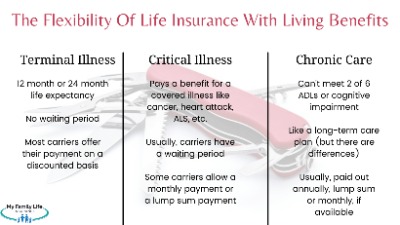

Some plans pay if you create a chronic/terminal ailment and some supply financial savings you can utilize to support your retirement. In this post, discover the various advantages of life insurance policy and why it may be a good concept to purchase it. Life insurance coverage provides benefits while you're still alive and when you die.

Hsmb Advisory Llc Things To Know Before You Buy

If you have a policy (or plans) of that size, individuals that depend upon your income will still have cash to cover their ongoing living expenditures. Beneficiaries can use plan benefits to cover essential daily expenditures like rent or home mortgage settlements, utility expenses, and grocery stores. Typical yearly expenditures for houses in 2022 were $72,967, according to the Bureau of Labor Stats.

Hsmb Advisory Llc Can Be Fun For Everyone

Development is not influenced by market problems, permitting the funds to build up at a steady rate in time. Furthermore, the money value of whole life insurance policy expands tax-deferred. This suggests there are no revenue taxes built up on the money worth (or its development) up until it is withdrawn. As the money worth builds up in time, you can use it to cover costs, such as purchasing a vehicle or making a deposit on a home.

If you make a decision to borrow against your cash money worth, the loan is exempt to earnings tax as long as the policy is not surrendered. The insurance provider, nonetheless, will certainly charge interest on the car loan amount till you pay it back (https://nowewyrazy.uw.edu.pl/profil/hsmbadvisory). Insurer have differing interest prices on these loans

The Greatest Guide To Hsmb Advisory Llc

8 out of 10 Millennials overestimated the expense of life insurance coverage in a 2022 research. In truth, the average expense is better to $200 a year. If you believe investing in life insurance coverage might be a wise monetary move for you and your family, consider talking to a monetary consultant to embrace it into your monetary strategy.

The 5 primary sorts of life insurance are term life, whole life, global life, variable life, and final cost coverage, additionally called funeral insurance coverage. Each kind has various features and advantages. For instance, term is a lot more affordable but has an expiry day. Whole life starts setting you back much more, however can last your entire life if you maintain paying the premiums.

4 Easy Facts About Hsmb Advisory Llc Shown

It can repay your financial debts and medical expenses. Life insurance can likewise cover your home mortgage and offer cash for your household to keep paying their expenses. If you have family members depending on your revenue, you likely require life insurance policy to sustain them after you die. Stay-at-home moms and dads and entrepreneur likewise usually require life insurance.

For the a lot of component, there are 2 types of life insurance policy intends - either term or permanent plans or some mix of the two. Life insurance companies use numerous kinds of term strategies and typical life policies as well as "interest delicate" products which have become a lot more common since the 1980's.

Term insurance provides defense for a given time period. This duration might be as short as one year or provide insurance coverage for a details variety of years such as 5, 10, 20 years or to a defined age such as 80 or in some cases up to the earliest age in the life insurance policy mortality.

The 20-Second Trick For Hsmb Advisory Llc

Presently term insurance coverage prices are extremely competitive and among the lowest traditionally skilled. It needs to be noted that it is an extensively held idea that term insurance is the least expensive pure life insurance protection offered. One requires to evaluate the Visit This Link plan terms carefully to determine which term life options appropriate to fulfill your specific circumstances.

With each new term the premium is boosted. The right to renew the policy without proof of insurability is a vital advantage to you. Otherwise, the threat you take is that your health may degrade and you may be incapable to obtain a policy at the same prices or perhaps at all, leaving you and your beneficiaries without protection.